Within hours of Obama’s reelection on Tuesday, Senate Minority Leader Mitch McConnell (R) interpreted the Obama win and Democratic victory in the Senate by declaring that the election is not a mandate for Obama’s policies and that Obama’s job now is to propose something that will pass the GOP controlled House.

The next day, House Speaker John Boehner (R) declared, in conciliatory tones, that the high-income tax increases on which Obama ran and was reelected was a non-starter.

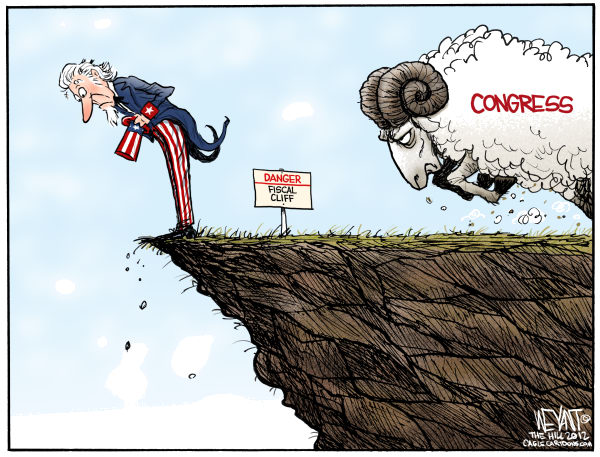

Meanwhile, the “fiscal cliff” looms around the corner. On January 1, 2013, the U.S. economy will be jolted by the convergence of the expiration of the Bush tax cuts, expiration of emergency unemployment insurance, an increase in the alternative minimum tax, and nearly $ trillion in across-the-board military and non-military spending cuts. The Congressional Budget Office recently released their assessment that going off the “fiscal cliff” would push the U.S. economy into another recession.

With continued Republican intransigence and a major economic downturn looming, Obama faces huge challenges in the next two months. The President should hold firm on the promises and policies he ran on in his reelection campaign, and here are 5 reasons why he can deliver.

Elections Matter

Obama ran a campaign on a few clear and simple economic policy concepts, which included letting the Bush tax cuts expire on higher income Americans towards the goal of reducing the deficit by $4 trillion. He repeated this platform endless times and, when pressed made this a crystal clear campaign promise. He won the election. Many Democratic Senators likewise ran on expiration of the Bush tax cuts and won. This gives Obama and Democrats a mandate to deliver on his promise with the backing of an electoral mandate.

Stalemate Results in Higher Taxes for Everyone

John Bohener has indicated that raising taxes would not pass the Republican House. But because the Bush tax cuts are set to expire already, a stalemate on this issue mans that taxes are going up without the cooperation of the Republican House. Republicans used obstructionism to great effect in preventing most of Obama’s first-term agenda in a bid to defeat him in the Presidential election, but in this case obstructionism is a big loser for Republicans. If no deal is made, taxes go up to Clinton rates, and that’s just fine with many Americans. Even the CBO’s assessment, which warns of an economic recession, estimates that by 2014 the economic pain of the fiscal cliff would be over, and thanks to a return to Clinton tax rates, the deficit would be much reduced. Even some Republicans believe that we should jump off the fiscal cliff in order to reduce deficits. The bottom line is that the Democrats hold most of the cards and the Republicans have few, and Obama should carefully use this fact not only to push the tax agenda he ran on for the last year, but also to force House Republicans to (finally) negotiate and compromise on a big deal that restructures and simplifies our tax code and promotes the President’s agenda, such as investing in infrastructure, education, and clean energy.

Tax Cuts for the Rich Do Not Work

I have written at length about why the Bush tax cuts specifically and tax cuts for the rich in general have never worked to create economic growth. As written on this blog here, tax cuts for the rich do not work to stimulate economic growth. A non-partisan Congressional Research Service report examining 65 years of economic data concluded that there is no correlation between lower capital gains or high-income income tax rates and economic growth:

“The reduction in the top tax rates appears to be uncorrelated with saving, investment and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.”

The GOP point to a study funded by the U.S. Chamber of Commerce and conducted by former Bush appointees working at Ernst & Young that claims that cutting the Bush tax cuts for the rich will cause the loss of ~700,00 jobs. The White House and fact checkers point out that this study makes some scrupulous assumptions, including the assumption that the new revenues would be used for new spending instead of tax cuts elsewhere as well as debt reduction. The Ernst & Young study even agreed with CBO that extending only the middle income tax cuts vs. all of the Bush tax brackets “would be more cost-effective in boosting output and employment in the short run because the higher-income households that would probably spend a smaller fraction of any increase in their after-tax income would receive a smaller share of the reduction in taxes.”

But it doesn’t necessarily take a study for most Americans to know that extending the Bush tax cuts are not the answer. The years following the Bush tax cuts were marked by anemic job growth, massive deficits and debt, and eventually a historic economic crash. Even Reagan’s 1981 tax cuts, which are credit by some to be stimulative, ballooned the budget deficit and necessitated a number of tax increases later in Reagan’s Presidency. In a great piece by Reagan adviser and Bush (Sr.) Treasury official Bruce Bartlett, Bartlett explains why the Reagan tax cuts wouldn’t work today:

Today, by contrast, income tax rates are at a historical low – the top tax rate is just 35 percent and revenues are less than 15 percent gross domestic product versus 19.6 percent in 1981. The average federal income tax rate on a median family is less than 5 percent and its marginal rate is 15 percent. Inflation is nonexistent and the federal funds rate is close to zero.

Republicans also continue to repeat the misleading claim that expiring Bush tax cuts for the top income brackets hurt small businesses. In fact, according to the non-partisan Tax Policy Center, only 2% of small businesses are in the top two income brackets that would be impacted by a tax increase on income over $250,000 per year. According to the Joint Committee on Taxation, such a tax increase would impact 3% of all businesses. The GOP definition of “small business” misleadingly includes some of the largest and richest corporations in the world, including many hedge funds, law firms, and corporate giants like Bechtel, Price Waterhouse Coopers, and even the infamous Koch Industries, which has over 70,000 employees. They have been called on it many times, yet continue to repeat this misleading claim.

With record deficits, a massive debt, and historically low tax rates, it is indefensible to insist on high-income tax cuts that add nearly $1 trillion to the debt over 10 years and have no discernible positive impact on economic growth.

Imaginary GOP Mandate

Both Bohener and McConnell point to the fact that Republicans retained control of the House as a mandate for lower taxes and a call for Presidential leadership. But let’s look at the facts: The vast majority of Americans, 75%, disapprove of the GOP Controlled House. In fact, more Americans, by a 48.8% to 48.5% margin, voted for Democrats than for Republicans in House races nationwide. But for two decades straight, Republicans have controlled the majority of State legislatures on years ending in 0 (2000 and 2010), which means they have gerrymandered districts (meaning they redraw district maps to select the voters they want in order to win more House seats), that give them a structural advantage and ensures them more seats in the House even when they get fewer actual votes across all House races. This is why the GOP retained control of the House by a healthy margin even while Democrats picked up seats in the Senate and won the White House. The Senate is decided on statewide votes, meaning that redistricting does not impact Senate seats. Likewise the White House race is decided by majority votes in each state, which is not impacted by Republican gerrymandered districts. The House is thus not representative of the will of the people, and retaining control in the House does not translate to a mandate. In other words (no surprise here), the GOP Controlled House is farther to the right than America, and the President should drive this point home. President Obama has a duty to lead, but the burden also lies on John Boehner to lead his right-wing caucus to where the American people are, no the other way around.

Obama’s Opportunity

With a mandate on policy, a reinvigorated base, and a looming fiscal cliff, Obama has a big opportunity and little room for error. His job now is to use the leverage he has over the House GOP, not giving up much, but reaching out to the GOP (not just Bohener) to such an extent that any intransigence on the part of House Republicans will be nakedly on display to the American people. Obama needs to keep the American people engaged, at least for the next two months, in order to hammer home a grand deal. What Obama can’t do is repeat the mistakes of his first term by letting the GOP obstruct his policies and ignore his attempts at compromise. What Obama can’t do is to allow a temporary fix to diminish the potential of his current political capital and extend the policy and tax rate uncertainty that is the main reason why the engines of the private sector have been idling for so long. Obama has a chance to lead, and a big victory is very possible for him and the American people.

2 Responses to Obama’s Opportunity – possibilities and pitfalls of the next 2 months