Opponents of renewable energy (it’s hard to believe they exist) claim that renewables cannot compete economically with oil, gas, and nuclear power. I have discussed the fallacy in this argument from an economic theory point of view here, but it is also important to point out that the subsidies for renewables are a tiny fraction of those for coal, oil, and gas. Many reports on this topic focus on the comparison of overall subsidies to fossils and nuclear vs. oil & gas, but in the context of all the criticism that the Department of Energy (DOE) has gotten after one of their many investments in renewables failed, I thought it would be interesting to look at the comparison of just DOE R&D funding on fossils and nucelar vs. renewables.

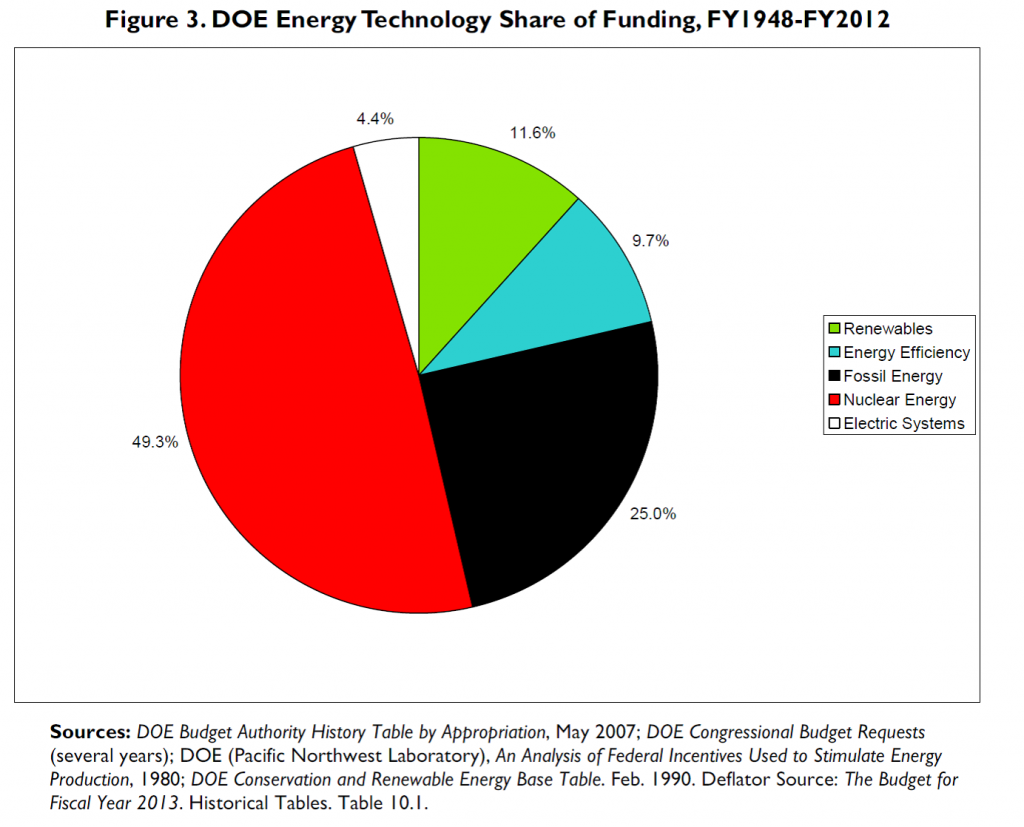

The non-partisan Congressional Research Service published a recent report documenting the history of R&D funding by technology. The conclusion: whether you look back 65 years or just over the last 10 years when R&D investment in renewables R&D have spiked, DOE spending on R&D for fossil fuels and nuclear has been far greater than spending for renewables R&D. The below figure from the report shows the share of R&D spending by technology type from 1948-2012. About 75% of DOE R&D funding have gone to nuclear or fossil fuel technologies:

The fact is that R&D is good for society and is under-provided by markets thanks to the economic concept of “market failure” discussed here. It may be entirely appropriate to invest in R&D on even mature industries like fossil fuels and nuclear. But it is inarguably wrong to oppose such investments in renewables when fossil fuels and nuclear power have benefited from such investments for many decades.

2 Responses to Fossil Fuels & Nuclear Lion’s Share of DOE R&D Subsidies